You can calculate customizable wages, deductions, and PTOs, execute an unlimited number of payroll runs, and pay employees through ACH direct deposits or printed MICR-encoded checks. Business owners, employers, HR managers, accountants, and finance professionals are among them. This easy-to-use, robust, and flexible solution helps various types of users manage payroll in a more efficient, accurate, affordable, and secure way.

#Checkmark payroll pricing software

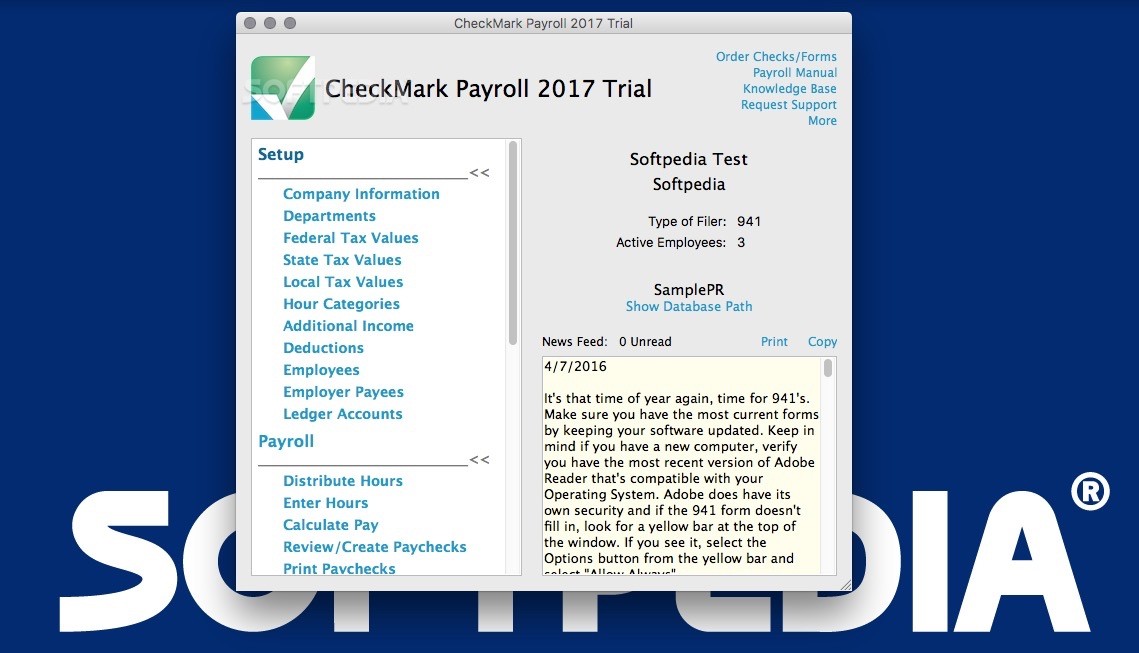

“We are also looking to foray into Europe and the Middle East, customizing our software to meet the distinct needs of customers in these countries,” concludes Ghani.CheckMark Payroll is a standalone desktop payroll software that solves the needs and challenges of small and medium US-based companies and businesses in handling employee payments and maintaining compliance with payroll and tax regulations. The company is all set to introduce a pay-per-use, cloud-based SaaS version of their software. Customers can submit their employee and payroll information to CheckMark’s certified payroll specialists, who take care of their entire payroll process from completing the calculations to filing and paying the necessary taxes. To make payroll even simpler, CheckMark offers payroll services. In no time, the customer was able to effortlessly create paychecks, make direct deposits, and print out forms to pay taxes to the IRS. As the customer had limited computer expertise, he was in need of individualized training and support, which CheckMark’s knowledgeable U.S.-based team was more than happy to provide. Ghani cites an instance where CheckMark’s prompt, efficient support service was able to help an elderly customer who needed help downloading, installing, and setting up the payroll software that he had just purchased. In addition, customers have instant access to support through the Live-chat feature on CheckMark. “Customers who choose priority support have access to 300 minutes of support instead of the standard 90 minutes,” explains Ghani. For customers who require immediate support or additional assistance, CheckMark offers them priority support. For instance, CheckMark’s software is used extensively in doctor’s offices, churches, and other religious organizations that do not have many employees.ĬheckMark Payroll software incorporates all payroll calculations and provides customers with the current tax tables that are up to date with the latest legislationĬheckMark also offers flexible support plans which are included in the purchase price of their payroll software. The company caters to the needs of almost every industry and has garnered a multitude of customers in specific niches. On average our customers usually have 15 to 20 employees,” remarks Ghani. “CheckMark software is extremely flexible and can seamlessly adapt to any business. The software is highly intuitive and simple to use, allowing business owners to easily set up and process their payroll in just a few clicks. Over the years, CheckMark Payroll Software has been refined with new features and encompasses all aspects of payroll processing. According to Mohammed Ghani, president and CEO of the company, “CheckMark Payroll Software incorporates all payroll calculations and provides customers tax tables that are kept up to date with the latest legislation.” and Canada to simplify their payroll functions for over 35 years. As a leader in the payroll software industry, CheckMark has helped over 8000 small businesses across the U.S. has developed a fast, easy-to-use, and affordable accounting and payroll solution designed specifically for small and medium-sized businesses. To streamline this complicated process, Colorado-based CheckMark, Inc. This is what CheckMark intends to change. This can result in crippling penalties due to incorrect calculation of payroll taxes and other payroll related costs. Often, small businesses owners find themselves ill-equipped to manage complexities in salaries, contributions, benefits, taxes, and more. Mohammed Ghani, President & CEO It is crucial to have an accurate payroll processing system in place for any business to be successful.

0 kommentar(er)

0 kommentar(er)